Robinhood Gold Card at Costco: Is the '5% Cash Back' Strategy Real?

If you are a Costco regular, you probably know the "standard" math by heart. You grab the Executive Membership for 2%, you swipe the Citi Costco Anywhere Visa for another 2%, and you walk away with a respectable 4% return.

That has been the gold standard for years.

But recently, a new contender has entered the chat, promising to bump that return up to a practically unheard-of 5%. The strategy involves stacking the Costco Executive reward with the buzzy new Robinhood Gold Card.

It sounds great on paper (3% card + 2% membership = 5%), but is it actually that clean in practice?

We ran the numbers to see if the fees justify the hype, and where the math falls apart.

(Major hat tip to Stellar Parallax [@synthenergy on X/Twitter] for originally surfacing this stacking idea. It’s a genuinely clever find.)

First: Can you actually use the Robinhood Gold Card at Costco?

Yes. This is the easy part.

Costco warehouses in the U.S. famously only accept Visa credit cards. Since the Robinhood Gold Card is issued on the Visa network, it works at the register just like your debit card or the Costco Citi card.

Compatibility isn't the issue. The real question is whether the rewards actually stack the way the internet says they do.

The Strategy: How 2% + 3% ≈ 5%

This hack works because you are effectively double-dipping into two completely separate reward ecosystems:

- Costco Executive Membership (2%): This is a reward from Costco itself, effectively a rebate check sent to you annually based on your qualified spend.

- Robinhood Gold Card (3%): Robinhood markets their card (currently via waitlist) as earning a flat 3% cash back across the board (provided you maintain a Robinhood Gold subscription).

So, when you buy a giant TV or a year’s supply of paper towels, you are earning: 2% (from Costco) + 3% (from Robinhood) = ~5% total return.

It’s a powerful combo. But, and there is always a "but", you have to watch out for the exclusions.

The "Gotcha": The Gas Station Problem

This is the most critical detail that gets glossed over in tweets and TikToks: The Costco Executive 2% reward does not apply to everything.

The biggest exclusion? Gas.

While the Robinhood card might still give you 3% at the pump, Costco’s Executive membership gives you 0% on fuel. That means your "5% strategy" suddenly drops to 3% when you fill up.

(The Executive reward also excludes things like Costco Shop Cards and postage, but gas is the big one for most families.)

The Takeaway: This strategy is a winner for merchandise (groceries, electronics, furniture), but it’s actually weaker than the Costco Citi card (4%) for gas.

The Business Case: Do the fees make sense?

We need to treat this like a business decision. You aren't just swiping a card; you are managing subscriptions.

- Costco Executive Upgrade: ~$65/year (over the basic Gold Star price)

- Robinhood Gold Subscription: $50/year (if annual) or $60 (monthly)

- Total "Optimization Cost": ~$115/year

Scenario A: You currently use a basic 2% card

If you are coming from a flat 2% card, jumping to ~5% is a massive upgrade (+3%). To break even on that ~$115 cost, you need to spend about $3,833/year on eligible Costco merchandise. Everything after that is pure profit.

Scenario B: You already have the Costco Citi Card (4%)

This is a harder sell. You are only moving from 4% to ~5% (a +1% gain). To justify the Robinhood Gold fee purely for Costco benefits, you’d need to spend $5,000/year on eligible merchandise just to break even.

Too much math?

If you’re tired of calculating break-even points or wondering if your annual spend justifies a new annual fee, this is exactly why we built CardSavvy Optimize. You plug in your spend habits, and the app tells you exactly which card setup yields the highest net return after fees, so you don't have to do this algebra in the grocery aisle.

Try the Free Optimizer vs. Your Wallet →

The "Perfect" Hybrid Setup

If you decide to go for it, don't throw your Costco Citi card in the shredder yet. The most optimized wallet actually uses both:

- For the Warehouse (Merch/Groceries): Swipe the Robinhood Gold Card. (Goal: ~5% return with Executive).

- For the Pump (Gas): Swipe the Costco Citi Card. (Goal: 4% return, beating Robinhood’s 3%).

Is there a ceiling higher than 5%?

Believe it or not, yes.

If you are deep in the credit card game, the Robinhood strategy is great, but the Bank of America ecosystem can actually push you to 5.5% total return without an annual fee, provided you have a relationship balance with the bank.

Here is the math for Platinum Honors members:

- Bank of America Customized Cash Rewards: Earns 3.5% on Wholesale Clubs (2% base × 1.75 multiplier).

- Costco Executive Membership: Earns 2%.

- Total: 5.5% back.

It’s a higher barrier to entry (requires $100k in assets with Merrill/BofA), but it yields the highest possible return.

Read our full breakdown: How to Earn 5.5% Cash Back at Costco with Bank of America →

Bottom Line

The Robinhood Gold Card + Executive Membership stack is legitimate. For families who spend heavily on groceries and electronics at Costco, earning ~5% back is fantastic.

Just remember: it’s not "free money." You have to spend enough to clear the subscription fees, and you need to remember that the gas pump plays by different rules.

Have you tried this stack? Let us know if the Robinhood approval process was smooth for you.

Related on Learn

Hand-picked based on topic and reader interest

Costco PayPal Debit Card Strategy: How to Get 7% Cash Back (2026)

Can you use PayPal at Costco? Yes—and the PayPal Debit Card earns 5% back. Stack it with Executive membership for 7% total. Here's the complete strategy.

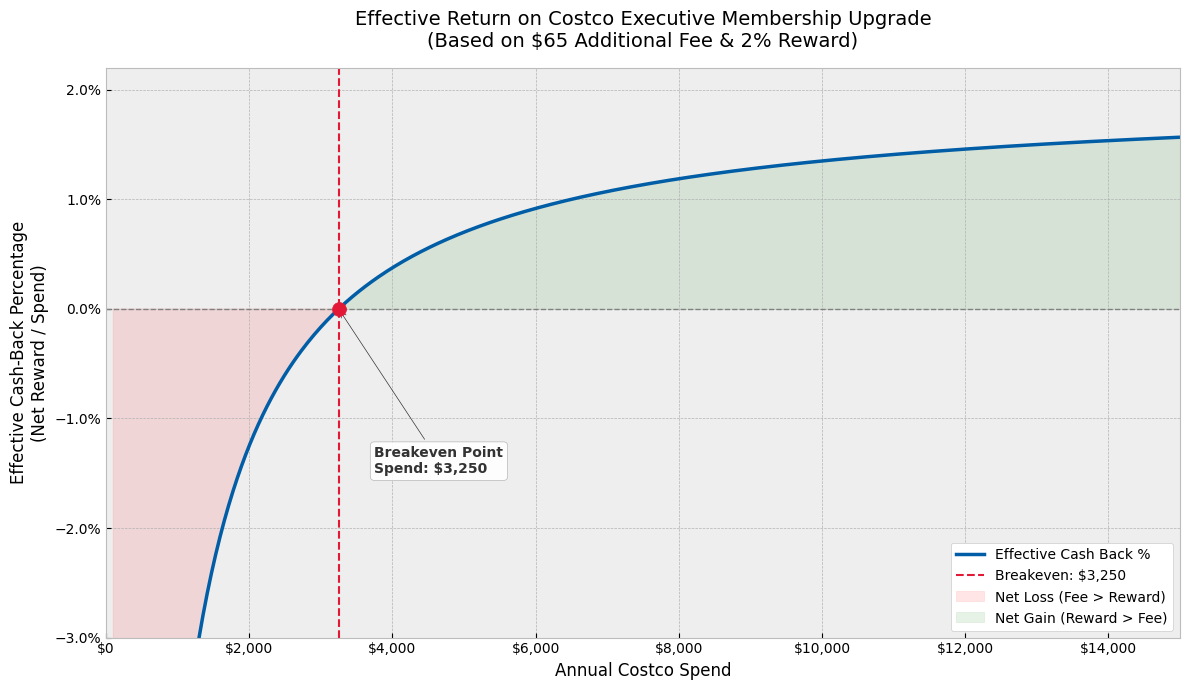

Are You *Really* Getting 2% Cash Back with Costco Executive? (The Math Says No)

The Costco Executive membership promises a 2% reward, but the $65 upgrade fee eats into your returns. We did the math to find your *true* effective cash-back rate.

How My Family Earns 5.5% Cash Back at Costco (And Effectively Doubles Our Rewards Cap)

Learn how we stack the Costco Executive Membership with the Bank of America Preferred Rewards "Platinum Honors" tier to earn 5.5% back on wholesale club purchases—and how we navigated the spending limits.

The 2-Card Wallet That Beats 90% of Trifectas

Stop juggling 5 cards. We break down three 2-card setups that mathematically outperform most complex trifectas—with half the mental overhead.

Get smarter with your cards

Weekly credit card strategy tips backed by math. No spam. Unsubscribe anytime.

Join 150+ readers. We respect your inbox.

Ready to optimize your wallet?

Get personalized card recommendations and spending strategies in under 2 minutes.

Free to use. No signup required.

Get My Strategy →