How My Family Earns 5.5% Cash Back at Costco (And Effectively Doubles Our Rewards Cap)

The "Toddler Tax" and Our Costco Addiction

If you have a toddler, you know that your house eats berries, diapers, and organic pouches at an alarming rate. Since our little one started eating solids, our Costco runs have shifted from "occasional stock-up" to "weekly survival ritual."

By my back-of-the-envelope calculations, our household is now firmly in the top 2% of Costco spending households. We aren’t just buying bulk; we are living in bulk. But as a finance nerd (and the builder of the CardSavvy Optimizer), I couldn’t just watch those receipts print out without optimizing every dollar.

Here is the exact math behind how my spouse and I stack memberships and credit card multipliers to get an unbeatable 5.5% return on our Costco spending, and how we structured our accounts to bypass the annoying quarterly caps.

Layer 1: The Executive Membership Math

First, the basics. We upgraded to the Costco Executive Membership.

- Cost: $130 annual fee ($65 more than the standard Gold Star membership).

- Benefit: 2% annual reward on qualified Costco purchases (capped at $1,250/year).

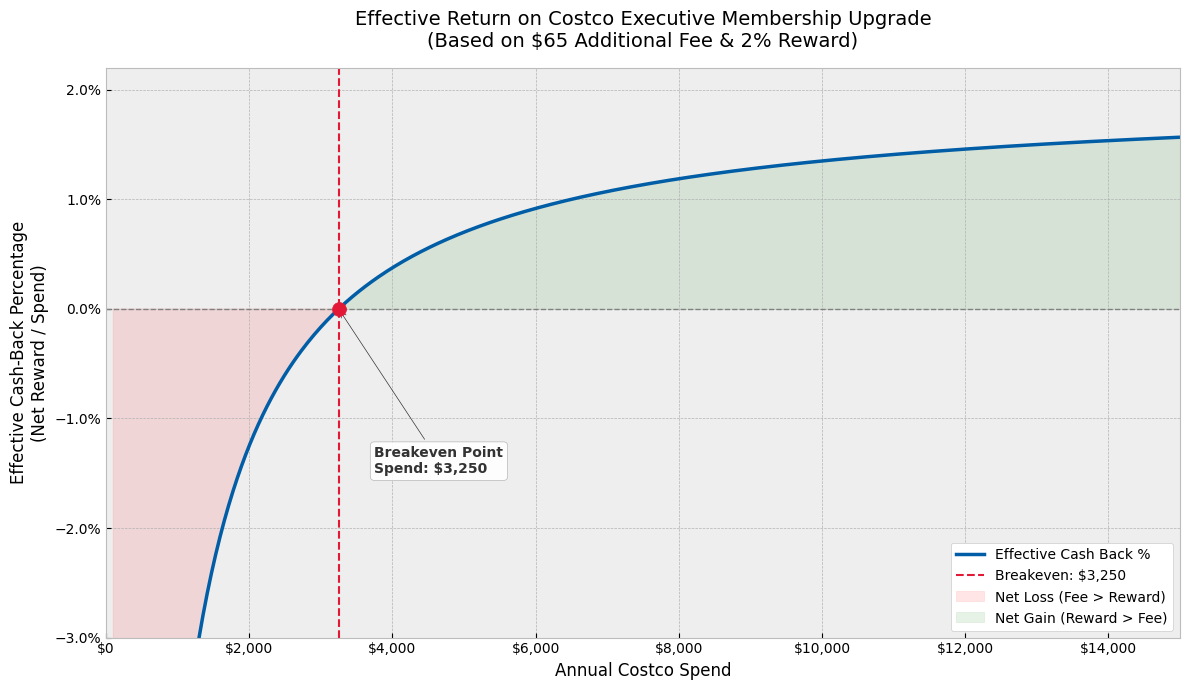

The Break-Even Point: To recoup the extra $65 upgrade fee, you only need to spend $3,250 a year (about $271/month) at Costco. Since we blow past that number every year, this was a no-brainer. This earns us our first 2% back.

Layer 2: The Bank of America "Platinum Honors" Multiplier

This is where the real magic happens. We don't use the Costco Citi card (which earns 2% at Costco). Instead, we use the Bank of America® Customized Cash Rewards credit card.

Standard users get 2% cash back at wholesale clubs. However, we are members of BofA’s Preferred Rewards program. Because we hold over $100,000 in assets in a linked Merrill Edge brokerage account, we qualify for the Platinum Honors tier (often confused with the "Platinum" tier, but "Honors" is the key for the highest bracket).

The Multiplier Effect: Platinum Honors members receive a 75% rewards bonus on their credit cards.

- Base Reward: 2% on Wholesale Clubs

- Multiplier: 1.75x (2% base + 75% bonus)

- Total Cash Back: 3.5%

The Investment Hack: You don’t need $100k in cash sitting in a low-interest savings account to qualify. We keep our balance invested in low-cost Vanguard ETFs within our Merrill Edge account. This allows our money to grow with the market while simultaneously unlocking the highest credit card reward tiers.

The Stack: 5.5% Total Rewards

When we swipe our BofA card at the Costco register:

- 2% accumulates in our annual Costco reward check.

- 3.5% hits our Bank of America cash rewards balance.

- Total: 5.5% cash back on every diaper box and rotisserie chicken.

Layer 3: The "Two-Player" Mode (Beating the Cap)

There is one "gotcha" with the Bank of America Customized Cash Rewards card: it has a spending cap. You only earn 2% (boosted to 3.5%) on the first $2,500 in combined choice category/grocery/wholesale club purchases each quarter.

With a toddler and a high run-rate at Costco, we sometimes blow past $2,500 every three months in addition to our savings earning 5.25% cash back on online purchases with our Bank of America Customized Cash Rewards card.

The Solution: My spouse and I each have our own Bank of America Customized Cash Rewards card.

- Player 1 Limit: $2,500/quarter

- Player 2 Limit: $2,500/quarter

- Total Capacity: $5,000/quarter ($20,000/year)

By holding two separate cards, we effectively double our reward-eligible spending bandwidth. We simply label one card "Costco Card A" and the other "Costco Card B" and swap them out once we see the first one hit the limit on our banking app.

The Bottom Line

Let's run the numbers for an annual Costco spend of $10,000 (about $830/month). While that is a high number, it is a realistic target for a family that relies on Costco for everything from weekly groceries and diapers to electronics and travel.

Here is how the math shakes out when comparing a standard credit card to this stacked strategy:

- Standard 1.5% Card: $150 cash back

- Our 5.5% Stack: $550 cash back ($200 from Costco + $350 from BofA)

- CardSavvy Take: This is exactly the kind of "hidden multiplier" our algorithms look for.

That is an extra $400 a year in our pocket. When you are spending that much volume, leaving 4% on the table isn't just a rounding error, it's a missed opportunity.

Disclaimer: This post is for informational purposes only. Bank of America and Costco terms are subject to change. Check current fee structures and reward limits before applying.

Related on Learn

Hand-picked based on topic and reader interest

How My Family Earns 5.25% Cash Back on Online Shopping (And Doubles Our Rewards Cap)

We unlocked 5.25% cash back on almost everything we buy online by stacking Bank of America Preferred Rewards with a strategic category selection—here is the exact setup.

Are You *Really* Getting 2% Cash Back with Costco Executive? (The Math Says No)

The Costco Executive membership promises a 2% reward, but the $65 upgrade fee eats into your returns. We did the math to find your *true* effective cash-back rate.

Costco PayPal Debit Card Strategy: How to Get 7% Cash Back (2026)

Can you use PayPal at Costco? Yes—and the PayPal Debit Card earns 5% back. Stack it with Executive membership for 7% total. Here's the complete strategy.

Robinhood Gold Card at Costco: Is the '5% Cash Back' Strategy Real?

We verify the viral 5% Costco hack using Robinhood Gold. Is the math solid?

Get smarter with your cards

Weekly credit card strategy tips backed by math. No spam. Unsubscribe anytime.

Join 150+ readers. We respect your inbox.

Ready to optimize your wallet?

Get personalized card recommendations and spending strategies in under 2 minutes.

Free to use. No signup required.

Get My Strategy →