Costco PayPal Debit Card Strategy: How to Get 7% Cash Back (2026)

TL;DR: Stack the PayPal Debit Card (5% on Groceries/Wholesale) with Costco Executive membership (2%) for 7% total cash back on warehouse purchases. Caveats: $1,000/month cap, must activate category monthly, and debit cards have fewer protections than credit cards. Skip to the math →

If you follow credit card optimization threads on Reddit or TikTok, you may have seen a bold claim recently: The PayPal Debit Card is the ultimate Costco card, earning 5% cash back. (Hat tip to @ragamuffingunn3 on X for highlighting this).

When stacked with a Costco Executive membership (2%), that's a potential 7% return on your warehouse runs. This rivals even the Bank of America Customized Cash strategy we've covered previously.

Want to see how this fits into your complete card strategy? →

Is it true? Mostly yes, but with some critical conditions.

The headline numbers are real, but the fine print matters. If you aren't careful, you could miss out on rewards or hit unexpected caps. Here is the complete breakdown of the PayPal Debit Card strategy for Costco shoppers.

The Strategy at a Glance

The core of this strategy relies on "stacking" two different rewards programs:

- PayPal Debit Mastercard®: Selecting "Groceries" as your 5% monthly category.

- Costco Executive Membership: Earning the standard 2% annual reward on qualified Costco purchases.

Total potential return: ~7% cash back.

Let's dig into the mechanics of how this works and, more importantly, where it might fail and when you should stick to a standard grocery card.

Part 1: The PayPal Debit Card (5%)

The PayPal Debit Card recently introduced a rotating monthly category feature. Here is how it works:

- The Reward: You earn 5% back in points on up to $1,000 of spend per month in a chosen category.

- The Categories: Options typically include Grocery, Gas, Dining, Health & Beauty, and Clothing.

- The Costco Connection: PayPal’s definition of the "Grocery" category explicitly includes wholesale clubs.

⚠️ The Catch:

This isn't automatic. You must select your category every single month in the PayPal app. If you forget to toggle "Grocery" on the 1st of the month, you earn nothing extra. Additionally, once you hit that $1,000 spending cap, your rewards drop to the base rate (usually 0% or negligible depending on current offers).

Part 2: The Costco Executive Membership (2%)

Costco’s paid Executive Membership ($130/year) offers a 2% annual reward on qualified Costco purchases, capped at $1,250 in rewards per year.

⚠️ The Catch:

The 2% reward applies to most warehouse purchases, but it excludes gas, tobacco, and alcohol in certain states. This is crucial because many people lump "Costco Gas" into their Costco budget.

⚠️ The Hidden Cost:

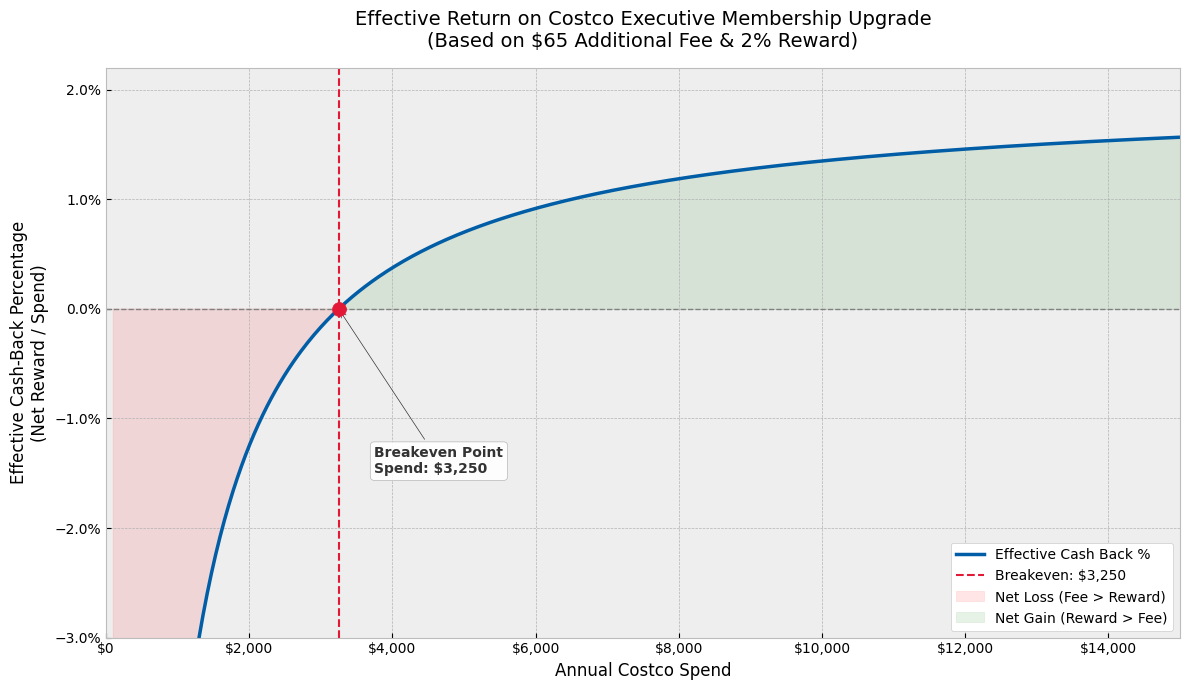

While you earn 2% back, remember that the Executive Membership upgrade costs an extra $65/year. You need to spend at least $3,250/year just to break even on that fee. If you spend less than that, your effective return is actually negative.

Read our full breakdown of the Executive Membership math here.

The Verdict: When Does This Work?

Scenario A: The Warehouse Run ✅

You activate the "Grocery" category on your PayPal Debit Card and spend $400 on bulk food and household goods at a Costco warehouse.

- PayPal: 5% of $400 = $20

- Costco Executive: 2% of $400 = $8

- Total: $28 (7% effective return)

- Result: It works. This beats almost every dedicated credit card on the market, including the Costco Anywhere Visa® (which earns 2% in-warehouse).

Scenario B: The Gas Station ❌

You fill up at Costco Gas.

- PayPal: Even if you selected "Gas" as your category, you can't double-dip categories. If you picked "Grocery" for the warehouse, you get 0% extra on gas. If you picked "Gas," you get 5%.

- Costco Executive: 0% (Gas is excluded).

- Total: Max 5% (if you prioritized gas over groceries).

- Result: Mixed. It's good, but you can't get the full 7% stack here.

3 Reasons Why This Isn't "Perfect"

Before you switch your payment method, consider these friction points:

- The $1,000 Monthly Cap: For families, a $1,000 monthly cap at Costco is easy to hit. Any spending over that limit earns you significantly less than a standard 2% flat-rate credit card would.

- Debit Card Protections vs. Credit: This is a debit card. While PayPal offers security, you generally have fewer consumer protections (like extended warranty or purchase protection) compared to premium credit cards.

- Funding Friction: You need to ensure your PayPal balance is funded or that "auto-reload" is set up correctly to pull from your bank, adding a layer of management that credit cards don't require.

Advanced: What About the Lost 'Float'?

Sophisticated optimizers might worry that using a debit card sacrifices the 'float', the interest earned by keeping cash in a high-yield account for ~30 days before paying a credit card bill. While this opportunity cost is real, the math shows it is negligible compared to the rewards spread.

At current T-bill yields (approx. 3.74%) and an assumed 35% tax rate, paying $1,000 immediately via debit costs you roughly $2.00 in lost after-tax interest. However, this strategy generates $70.00 in gross rewards ($50 from PayPal + $20 from Costco). Even after subtracting the $2.00 'cash drag,' you are left with a net gain of $68.00. This results in an effective return of 6.8%, which still vastly outperforms any credit card currently on the market for wholesale clubs.

Bottom Line

Is the PayPal Debit Card a "Costco Killer"? For moderate spenders who are organized enough to activate the category monthly, yes.

Getting 7% back on up to $12,000 of Costco spending a year is an unbeatable return. Just remember to activate your category, watch the $1,000 limit, and keep using your standard gas card at the pump.

Want to see how this fits into your overall wallet? Run your numbers through the CardSavvy Optimizer to check if your other spending habits justify a different strategy.

FAQ: PayPal at Costco

Does Costco accept PayPal?

Not directly. Costco does not accept PayPal as a payment method at checkout (either in-store or online). However, you can use the PayPal Debit Mastercard at Costco warehouses because Costco accepts all debit cards with Visa or Mastercard networks. This is the workaround that makes the 5% strategy possible.

Can you use PayPal Pay in 4 at Costco?

No. Costco does not support PayPal Pay in 4 or any buy-now-pay-later services. You must pay the full amount at checkout.

Does the PayPal Debit Card work at Costco Gas?

Yes, the PayPal Debit Card works at Costco Gas stations. However, you can only select one 5% category per month. If you chose "Grocery" for warehouse purchases, gas purchases earn the base rate (0%). You'd need to select "Gas" as your category to earn 5% at the pump.

Is the PayPal Debit Card a credit card?

No. It's a debit card linked to your PayPal balance or bank account. This means you don't get the same consumer protections (like extended warranty or purchase protection) that credit cards offer. However, it does qualify for Costco's debit card acceptance policy.

What's the monthly limit for PayPal's 5% category?

The 5% category bonus applies to up to $1,000 in spending per month. Any spending beyond that earns the base rate. For families with large Costco bills, this cap is easy to hit.

Disclaimer: Merchant category codes (MCC) are determined by the merchant, not PayPal. While Costco usually codes as a wholesale club (Grocery), edge cases exist. Always test a small purchase first.

Related on Learn

Hand-picked based on topic and reader interest

Robinhood Gold Card at Costco: Is the '5% Cash Back' Strategy Real?

We verify the viral 5% Costco hack using Robinhood Gold. Is the math solid?

Are You *Really* Getting 2% Cash Back with Costco Executive? (The Math Says No)

The Costco Executive membership promises a 2% reward, but the $65 upgrade fee eats into your returns. We did the math to find your *true* effective cash-back rate.

How My Family Earns 5.5% Cash Back at Costco (And Effectively Doubles Our Rewards Cap)

Learn how we stack the Costco Executive Membership with the Bank of America Preferred Rewards "Platinum Honors" tier to earn 5.5% back on wholesale club purchases—and how we navigated the spending limits.

Best Credit Card for Costco 2026: 5 Cards That Beat the Store Visa

What's the best credit card for Costco in 2026? We tested 5 cards that beat the Costco Anywhere Visa, including options earning up to 5.25% cash back.

Get smarter with your cards

Weekly credit card strategy tips backed by math. No spam. Unsubscribe anytime.

Join 150+ readers. We respect your inbox.

Ready to optimize your wallet?

Get personalized card recommendations and spending strategies in under 2 minutes.

Free to use. No signup required.

Get My Strategy →