Are You *Really* Getting 2% Cash Back with Costco Executive? (The Math Says No)

The Register Upsell

It happens to the best of us. You’re at the Costco checkout, cart loaded with bulk paper towels and a rotisserie chicken, when the cashier pauses.

"You know," they say, glancing at your total, "if you had the Executive Membership, this shop would practically pay for itself."

The pitch is seductive: Pay an extra $65 a year (on top of the standard $65 Gold Star fee), and get 2% cash back on almost everything you buy. It sounds like a no-brainer. If you spend enough, it’s free money, right?

Well, yes and no. While the 2% reward is real, your effective return isn't.

At Card Savvy, we don't just look at the rewards; we look at the net value. We modeled the math to see exactly what that "2%" is actually worth once you factor in the annual fee.

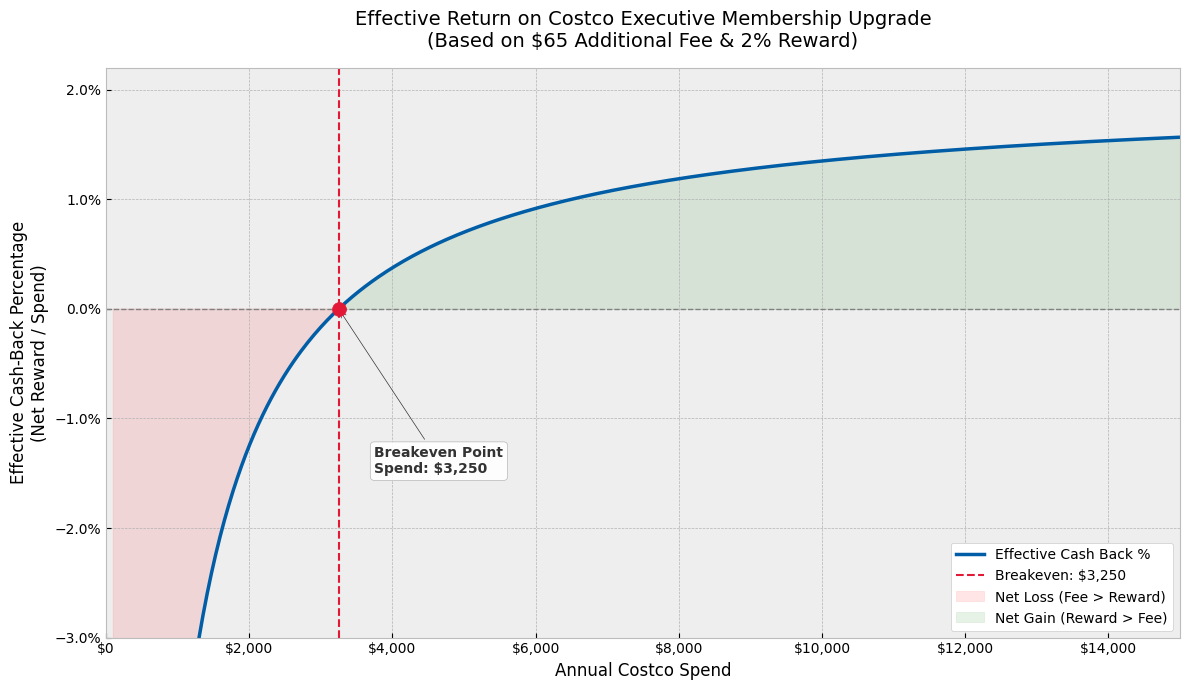

The Breakeven Reality: The First $3,250 is "Dead Money"

The most important number to remember is $3,250.

Until you spend exactly $3,250 at Costco in a year, you are technically losing money on the upgrade.

- Spend: $3,250

- 2% Reward: $65

- Cost of Upgrade: -$65

- Net Profit: $0

At this exact point, your effective cash-back rate isn't 2%. It is 0%. You have simply given Costco an interest-free loan of $65 for the year, which they kindly returned to you in a check months later.

The "Zone of Profit" (and Why 2% is a Myth)

Once you pass that $3,250 threshold, you enter the "Green Zone." You are now making a profit on the membership. However, because you started $65 in the hole, your effective return, the actual percentage of money back in your pocket, lags behind 2% for a long time.

Take a look at the breakdown:

| Annual Spend | Reward Check | Net Profit (After Fee) | Your REAL Return |

|---|---|---|---|

| $1,500 | $30 | -$35 (Loss) | -2.3% |

| $3,250 | $65 | $0 (Breakeven) | 0.0% |

| $6,000 | $120 | $55 | 0.9% |

| $10,000 | $200 | $135 | 1.35% |

| $15,000 | $300 | $235 | 1.57% |

The Insight: Even if you are a Costco power user spending $10,000 a year, your effective return on the upgrade is only 1.35%, not 2%. You never mathematically reach the full 2% because that fixed $65 fee is always dragging down your average.

The Safety Net: Why You Can't Actually Lose

There is one massive caveat to this math: Costco's 100% Satisfaction Guarantee.

If you don't hit the breakeven point, you can go to the membership counter at any time and downgrade to the Gold Star membership. Costco will refund you the difference between the upgrade fee and the rewards you earned.

- Example: If you paid the extra $65 for Executive but only earned $30 in rewards, you technically "lost" $35. Costco will refund that $35 loss upon downgrade.

This makes the upgrade effectively risk-free to try for a year. The worst-case scenario is that you simply paid the standard membership price.

So, Is It Worth It?

Despite the math showing you don't really get 2%, the Executive Membership is still a "Strong Buy" for many households, but only if you are honest about your spending.

You should upgrade if:

- You spend over $275/month ($3,300/year): This is the magic number. If you are a family of four, you likely hit this on groceries alone.

- You have a big purchase coming up: Buying a new appliance, a set of tires, or booking a Costco Travel vacation? One $4,000 vacation instantly clears the breakeven hurdle.

- You use Costco Services: The Executive membership often comes with other perks, like lower rates on Costco Auto insurance or check printing, which can subsidize the fee.

The "Card Savvy" Strategy: Double Dipping 2.0

Here is where the real magic happens. The Executive reward is a store rebate, not a credit card reward. This means it stacks perfectly with your payment method.

Most people settle for the Costco Anywhere Visa® (earning 2% in-store), for a total stack of roughly 3.5%. But at Card Savvy, we don't settle for standard.

Here are three advanced strategies to supercharge your return:

1. The "Monthly Hustle" Strategy (7% Return)

If you are willing to do a little work, the PayPal Debit Card is technically the highest earner on the market. By selecting "Grocery" as your monthly 5% category (which includes wholesale clubs), you can stack 5% from PayPal on top of your Executive 2%.

- The Stack: 2% (Executive) + 5% (PayPal) = 7% Total.

- The Catch: It’s capped at $1,000/month in spend.

- Read our full guide on the 7% PayPal Debit Strategy →

2. The "High Roller" Strategy (5.5% Return)

If you have significant assets with Bank of America or Merrill Edge, the Platinum Honors tier turns the Customized Cash Rewards card into a powerhouse. You get a 75% bonus on your rewards, boosting the "Wholesale Clubs" category to 3.5%.

- The Stack: 2% (Executive) + 3.5% (BofA) = 5.5% Total.

- The Catch: Requires $100k in assets and has a quarterly spending cap.

- See how our team earns 5.5% with Bank of America →

3. The "Set It and Forget It" Strategy (5% Return)

If you want simplicity without rotating categories or asset requirements, the Robinhood Gold Card offers a flat 3% cash back on everything, including Costco.

- The Stack: 2% (Executive) + 3% (Robinhood) = 5% Total.

- The Catch: You need a Robinhood Gold subscription, and gas purchases don't stack as well.

- Is the Robinhood Gold Card 5% Strategy Real? →

The Bottom Line

The Costco Executive Membership is a great deal, but it’s not a flat 2% rebate. It’s a tiered loyalty program where the first $3,250 of spending is merely the "entrance fee."

Check your annual summary from last year. If you hit that $3,250 number, keep the membership, but stop paying with a basic 1% or 2% card. Switch to one of the strategies above to ensure you're actually getting paid to shop.

Related on Learn

Hand-picked based on topic and reader interest

Costco PayPal Debit Card Strategy: How to Get 7% Cash Back (2026)

Can you use PayPal at Costco? Yes—and the PayPal Debit Card earns 5% back. Stack it with Executive membership for 7% total. Here's the complete strategy.

Robinhood Gold Card at Costco: Is the '5% Cash Back' Strategy Real?

We verify the viral 5% Costco hack using Robinhood Gold. Is the math solid?

How My Family Earns 5.5% Cash Back at Costco (And Effectively Doubles Our Rewards Cap)

Learn how we stack the Costco Executive Membership with the Bank of America Preferred Rewards "Platinum Honors" tier to earn 5.5% back on wholesale club purchases—and how we navigated the spending limits.

Best Credit Card for Costco 2026: 5 Cards That Beat the Store Visa

What's the best credit card for Costco in 2026? We tested 5 cards that beat the Costco Anywhere Visa, including options earning up to 5.25% cash back.

Get smarter with your cards

Weekly credit card strategy tips backed by math. No spam. Unsubscribe anytime.

Join 150+ readers. We respect your inbox.

Ready to optimize your wallet?

Get personalized card recommendations and spending strategies in under 2 minutes.

Free to use. No signup required.

Get My Strategy →