How My Family Earns 5.25% Cash Back on Online Shopping (And Doubles Our Rewards Cap)

The "Add to Cart" Lifestyle

If our Costco runs are a "weekly survival ritual," our online shopping is the daily tactical support. Between ordering toddler clothes that fit for exactly three weeks, replacement parts for broken toys, and the endless stream of household consumables, the delivery truck stops at our house often enough that it feels like there is a new brown box waiting at our door every time we come home.

Most people settle for a flat 1.5% or 2% cash back on these purchases. But as an engineer and the builder of CardSavvy, I refuse to leave nearly 4% on the table.

Here is how my family earns 5.25% cash back on almost all our online spend—and how we navigated around the spending caps that usually limit this strategy.

The Mechanism: Bank of America Customized Cash Rewards

The backbone of this strategy is the same card we use for Costco: the Bank of America® Customized Cash Rewards credit card.

The unique feature of this card is that it lets you pick one "Choice Category" to earn 3% cash back. The categories include Gas, Dining, Travel, Drug Stores, Home Improvement, and our winner: Online Shopping.

By default, you earn:

- 3% on your Choice Category (Online Shopping)

- 2% on Grocery Stores and Wholesale Clubs

- 1% on everything else

The "Platinum Honors" Boost (5.25% Total)

Just like with our Costco strategy, the secret sauce is the Preferred Rewards program. Because we hold over $100,000 in invested assets (mostly low-cost index funds) in a linked Merrill Edge account, we qualify for the Platinum Honors tier.

This tier grants a 75% bonus on all credit card rewards.

The Math:

- Base Reward (Online Shopping): 3%

- Multiplier: 1.75x (3% base + 75% bonus)

- Total Cash Back: 5.25%

This doesn't just apply to obvious retailers. Bank of America’s "Online Shopping" category is surprisingly broad, often covering app-based purchases, clothing stores, and even some utilities if paid via their websites.

What If You Don't Have $100k Invested?

I know $100,000 is a significant hurdle. However, this strategy is still potent at lower tiers. You don't need to be a millionaire to beat the standard 2% cards.

-

Gold Tier ($20k - $50k in assets): You get a 25% bonus.

- 3% becomes 3.75%.

-

Platinum Tier ($50k - $100k in assets): You get a 50% bonus.

- 3% becomes 4.5%.

Even at the Gold tier, earning 3.75% on your highest spend category is significantly better than a flat-rate card. (Curious if your current wallet beats this? Run a quick check with the CardSavvy Optimizer).

The Strategy: Navigating the $2,500 Cap

There is a catch. The Bank of America Customized Cash Rewards card caps your 3% (and 2%) earning categories at $2,500 in combined spending per quarter.

Between online shopping, groceries, and Costco runs, a family can hit that limit fast. If you go over, your rewards drop to a meager 1%. Here is our "Two-Part" solution to maximize the cap:

1. The "Amazon Bypass" (Use a Different Card)

Because Amazon and Whole Foods make up a huge chunk of our spending, we purposely do not put them on the Bank of America card. Instead, I personally use the Chase Amazon Prime Visa.

- Benefit: Unlimited 5% cash back on Amazon and Whole Foods.

- Why we do it: This offloads high-volume spending from our BofA card, saving that precious $2,500 quarterly limit for other online retailers (Nike, Target, Home Depot, etc.) and our Costco runs.

2. The "Double Dip" (Two-Player Mode)

Even with Amazon removed, we still have significant spend on other sites plus our grocery/Costco bills. To solve this, my spouse and I each hold our own Bank of America Customized Cash Rewards card.

- Card 1 (His): Set to Online Shopping. Cap: $2,500/quarter.

- Card 2 (Hers): Set to Online Shopping. Cap: $2,500/quarter.

Total Capacity: $5,000 per quarter ($20,000/year).

The Final "Hybrid" Setup

By setting our Choice Category to Online Shopping, we actually create a perfect hybrid card for our household needs:

- Online Shopping (Non-Amazon): Earns 5.25% (Base 3% boosted).

- Groceries & Costco: Earns 3.5% (Base 2% boosted).

We use the BofA cards for all general e-commerce and our Costco runs (capturing that solid 3.5%), while the Chase card handles the Amazon load.

The Bottom Line

If you spend $10,000 a year on general online shopping (outside of Amazon), the difference between a standard card and this optimization is striking:

- Standard 1.5% Card: $150 cash back

- Our 5.25% Strategy: $525 cash back

- CardSavvy Take: That is $375 in free money just for using the right piece of plastic.

It takes a little setup to link the accounts and track the caps, but for a return that rivals the stock market (risk-free!), it is absolutely worth the effort.

Disclaimer: This post is for informational purposes only. Bank of America, Merrill Edge, and Chase terms are subject to change. CardSavvy does not provide financial advice. Check current fee structures and reward limits before applying.

Related on Learn

Hand-picked based on topic and reader interest

How My Family Earns 5.5% Cash Back at Costco (And Effectively Doubles Our Rewards Cap)

Learn how we stack the Costco Executive Membership with the Bank of America Preferred Rewards "Platinum Honors" tier to earn 5.5% back on wholesale club purchases—and how we navigated the spending limits.

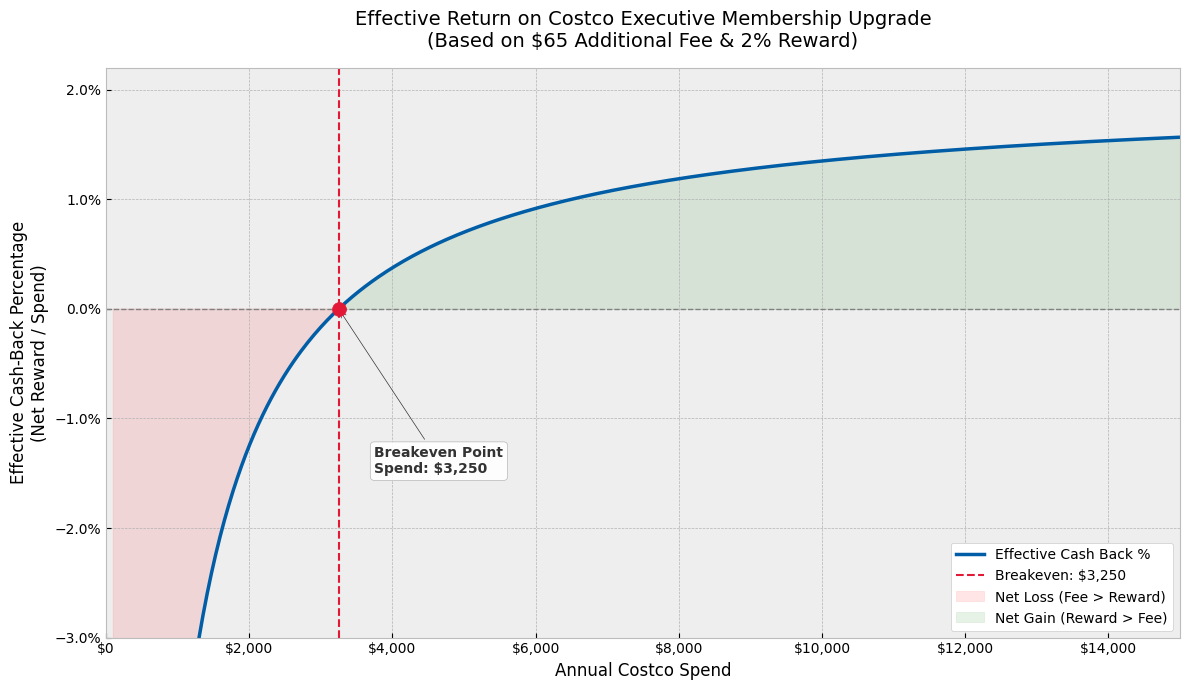

Are You *Really* Getting 2% Cash Back with Costco Executive? (The Math Says No)

The Costco Executive membership promises a 2% reward, but the $65 upgrade fee eats into your returns. We did the math to find your *true* effective cash-back rate.

Costco PayPal Debit Card Strategy: How to Get 7% Cash Back (2026)

Can you use PayPal at Costco? Yes—and the PayPal Debit Card earns 5% back. Stack it with Executive membership for 7% total. Here's the complete strategy.

Robinhood Gold Card at Costco: Is the '5% Cash Back' Strategy Real?

We verify the viral 5% Costco hack using Robinhood Gold. Is the math solid?

Get smarter with your cards

Weekly credit card strategy tips backed by math. No spam. Unsubscribe anytime.

Join 150+ readers. We respect your inbox.

Ready to optimize your wallet?

Get personalized card recommendations and spending strategies in under 2 minutes.

Free to use. No signup required.

Get My Strategy →