The 80/20 of Credit Card Rewards: The 5 Categories That Matter Most

Most people try to “optimize” their wallet by chasing a dozen tiny bonuses. That is backward.

If you want the biggest payoff for the least amount of effort, you need to focus on the categories where households actually spend money—and where reward rates differ meaningfully across cards.

This is the 80/20 rule of rewards: Optimize these five categories and you will capture the majority of the upside without turning your life into a spreadsheet.

Related: This aligns perfectly with our Math First Philosophy—focusing on the numbers that actually move the needle for your net worth.

The 5 Categories That Drive Your Rewards

1. Groceries

- Why it matters: For most families, this is the single largest credit-card-eligible expense. The difference between a standard card and a grocery-specific card is massive—often swinging from 1x to 4x–6x.

- The Common Mistake: Using a fancy "premium travel card" at the supermarket and earning only 1x points, when a no-annual-fee grocery card could be earning 3x or more.

- The Fix: If you only optimize one category, make it this one. (See our deep dive on Family Rewards Savings for more on this.)

2. Dining (Restaurants, Takeout & Delivery)

- Why it matters: Dining is a high-volume category that is incredibly easy to optimize. Many cards offer 3x–4x points (or strong cash back) as a standard benefit.

- The Common Mistake: Splitting dining expenses across random cards, or lazily using a catch-all 2% card when a 3x or 4x option is sitting in your wallet.

- The Fix: Pick one dedicated dining card and default to it every time—whether you are at a Michelin-star restaurant or ordering Uber Eats.

3. Travel (Flights, Hotels & "Other")

- Why it matters: Travel spend is "lumpy"—it doesn't happen every day, but when it does, the transactions are huge. Rewards here range from 1x up to 5x–10x.

- The Common Mistake: Getting a "travel card" for the status, but booking in ways that don’t actually earn the multipliers (e.g., booking direct when the card requires a portal, or vice versa).

- The Fix: If you don't travel much, don't force a high-fee card. If you do travel, optimize your booking method just as much as you optimize the card choice.

4. Gas & Transit

- Why it matters: This is a reliably large, predictable bucket for commuters.

- The Common Mistake: Optimizing for gas but forgetting about transit/rideshare (or vice versa). This leaves money on the table for city dwellers who rely on Uber or the subway.

- The Fix: Create a single mental bucket called “Getting Around.” Pick the card that covers how you actually move—whether that's a pump, a turnstile, or an app.

5. "Everything Else" (The Catch-All)

- Why it matters: Even if you optimize the first four categories, a huge chunk of your spending won’t fit into a bonus category: medical bills, insurance, auto repair, and random retail. If this bucket is large, your baseline earn rate is critical.

- The Common Mistake: Earning 1x points on thousands of dollars of "boring" spend out of habit. This is a classic example of leaving money on the table.

- The Fix: Ensure you have a strong catch-all card (flat 2% cash back or 2x points). This card quietly does the heavy lifting between the exciting purchases.

The "Don't Waste Time" Categories

These categories exist, but they are usually not worth optimizing early unless they represent a massive part of your specific budget. Don't let these distract you from the Big 5:

- Drugstores

- Streaming Services

- Home Improvement

- Online Shopping (often messy due to merchant coding)

- Quarterly Rotating Categories (high upside, but high maintenance)

If you enjoy the game, go for it. If you just want results, ignore them for now.

A Simple Way to Apply This

You don't need complex software to start. Just follow this 3-step audit:

- Estimate your annual spend in the Big 5 buckets (Groceries, Dining, Travel, Getting Around, Catch-all). Rough numbers are fine.

- Check your wallet. Do you have one strong card assigned to each of your high-spend buckets?

- Stop there. Most people capture the majority of their potential gains with just 2–4 cards.

The CardSavvy Angle: Find Your Leak

Different households leak rewards in different places. For some, it’s a 1x return on $15,000 of grocery spend. For others, it’s using a debit card for "everything else."

To optimize fast, don't ask "What is the best card?" Ask: "In which of the 5 categories am I under-earning the most?"

That is the fastest path to meaningful rewards.

TL;DR

To get 80% of the results with 20% of the effort, forget the niche bonuses and focus on:

- Groceries

- Dining

- Travel

- Gas + Transit

- Everything Else (Catch-all)

Get these right, and you’ll beat the “10-card wallet” crowd with a setup you can actually maintain.

Check your Wallet Health now to see where you stand.

Related on Learn

Hand-picked based on topic and reader interest

How Much Can Families Actually Save? The Math of Credit Card Optimization

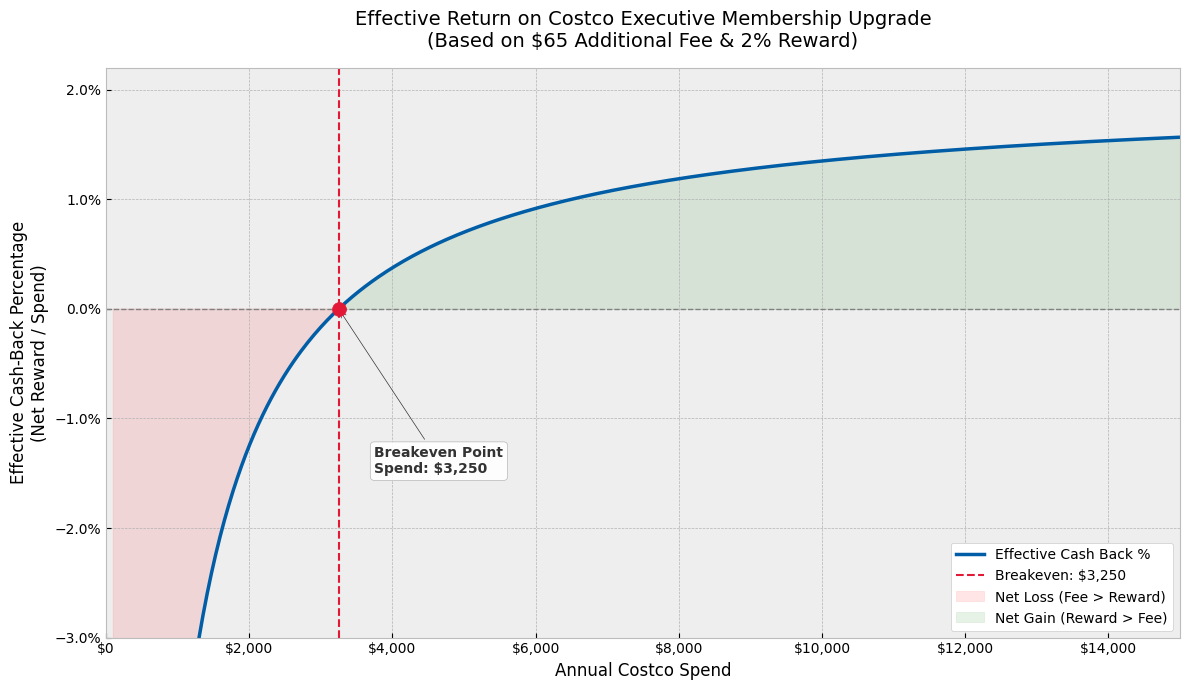

Are You *Really* Getting 2% Cash Back with Costco Executive? (The Math Says No)

The Costco Executive membership promises a 2% reward, but the $65 upgrade fee eats into your returns. We did the math to find your *true* effective cash-back rate.

Costco PayPal Debit Card Strategy: How to Get 7% Cash Back (2026)

Can you use PayPal at Costco? Yes—and the PayPal Debit Card earns 5% back. Stack it with Executive membership for 7% total. Here's the complete strategy.

Robinhood Gold Card at Costco: Is the '5% Cash Back' Strategy Real?

We verify the viral 5% Costco hack using Robinhood Gold. Is the math solid?

Get smarter with your cards

Weekly credit card strategy tips backed by math. No spam. Unsubscribe anytime.

Join 150+ readers. We respect your inbox.

Ready to optimize your wallet?

Get personalized card recommendations and spending strategies in under 2 minutes.

Free to use. No signup required.

Get My Strategy →