How Much Can Families Actually Save? The Math of Credit Card Optimization

Using credit cards strategically, by choosing the best card for each spending category, can yield substantial savings for American families. At CardSavvy, we often talk about "optimization," but what does that strictly look like in dollars and cents?

We crunched the numbers using recent Bureau of Labor Statistics (BLS) Consumer Expenditure data to estimate the annual rewards "savings" (i.e., additional cash or value earned) for three household profiles.

The bottom line? The average American family is likely leaving $300–$500+ on the table every year. For higher earners, that number easily eclipses $1,000.

Here is the math behind those numbers.

Spending Patterns and "Optimizable" Spend

First, we need to define "Optimizable Spend." Not every expense can be put on a credit card (mortgages, car payments, and tuition usually require bank drafts). However, huge chunks of a family budget are credit-card friendly.

According to BLS data, the average "consumer unit" (household) spends thousands annually on:

- Groceries (Food at home)

- Dining (Restaurants and takeout)

- Gasoline

- Travel (Flights, hotels, transit)

- Everyday Retail (Clothing, household furnishings, entertainment)

These are the "Big 5" categories where credit card issuers fight the hardest for your business, offering 3%, 4%, or even 5%+ back.

If you put these expenses on a basic debit card or a generic bank card, you likely earn 0% to 1% back. By optimizing—using specific cards for specific categories—you can realistically target an average return of 3–5%.

Case Study: Three Household Profiles

We modeled potential savings for three distinct family types based on income quintiles and spending habits.

1. The Average Family (Median Income)

- Profile: Median income (~$70k), 2-3 people.

- Optimizable Spend: ~$20,000 / year.

- Breakdown: ~$6k Groceries, ~$4k Dining, ~$2.5k Gas, ~$2k Travel.

The Math:

- No Optimization (1% card): Earns ~$200/year.

- Optimized Strategy (~3% avg): Earns ~$600–$700/year.

- Net "Profit": $400–$500 per year.

That extra $500 isn't magical free money—it's a return on spending you are already doing. That's enough to cover a major utility bill or a weekend getaway.

2. The Upper-Middle-Class Family

- Profile: Higher income (~$120k), 3-4 people, frequent travelers.

- Optimizable Spend: ~$30,000 / year.

- Breakdown: Higher grocery spend (

$7k), more dining out ($4.5k), and significantly more travel.

The Math:

- No Optimization (1.5% card): Earns ~$450/year.

- Optimized Strategy (~3-4% avg): Earns ~$900–$1,200/year.

- Net "Profit": $500–$800+ per year.

At this level, "premium" cards with annual fees often make sense because the higher reward rates (e.g., 6% on groceries or 4x points on dining) outweigh the costs.

3. The High-Income Optimizer

- Profile: Affluent ($200k+), large family or luxury travel habits.

- Optimizable Spend: ~$50,000+ / year.

- Breakdown: Spend is heavy across all categories, especially travel (

$7k+) and dining ($8k).

The Math:

- No Optimization (1.5% card): Earns ~$750/year.

- Optimized Strategy (~3-5% avg): Earns ~$1,500–$2,500+/year.

- Net "Profit": $1,000–$1,500+ per year.

For high spenders, the gap between "good" and "great" is massive. A savvy strategy here effectively subsidizes a significant portion of an annual vacation.

Summary Comparison

| Household Type | Approx. Annual Spend (Optimizable) | Rewards w/ Basic Card (1%) | Rewards w/ Optimized Cards (~3%+) | Potential Annual Gain |

|---|---|---|---|---|

| Average Family | ~$20,000 | ~$200 | ~$600 | +$400 |

| Upper-Middle | ~$30,000 | ~$450 (1.5%) | ~$900 | +$550 |

| High Income | ~$50,000+ | ~$750 (1.5%) | ~$1,800 | +$1,000+ |

> Note: Estimates derive from BLS Consumer Expenditure Survey (2023) data and typical market reward rates. "Potential Gain" accounts for estimated annual fees in optimized setups.

How to Capture This Value

You don't need 20 credit cards to see these results. Most of the value comes from just 2 or 3 well-chosen cards:

- A "Category Killer": A card dedicated to your highest spend (e.g., a card earning 6% on groceries).

- A Dining/Travel Card: Often combined, earning 3x or 4x on meals and trips.

- A "Catch-All" Card: A simple flat-rate card earning 2% on everything else (doctor's visits, car repairs, etc.).

Stops Leaking Money

The difference between using a debit card (0%) and a managed credit card strategy (3-5%) is effectively a 3-5% discount on your entire life. Over 10 years, an average family investing that $500 annual difference could have over $6,000 (assuming modest 4% compound interest).

Conclusion

In summary, a service like CardSavvy that tailors credit card recommendations to a family’s spending could boost the household’s annual rewards by a few hundred up to a thousand+ dollars depending on their spending level. The average American family might save on the order of $300–$500 per year through rewards optimization, while an upper-middle-class family could gain $500–$800 annually, and a high-income family perhaps $1,000 or more in extra rewards each year.

These estimates assume the family switches from a non-optimized approach (earning little to no rewards in many categories) to an optimal strategy (using the best card for groceries, gas, dining, travel, etc. to consistently earn 3–5% back). Actual outcomes will vary with individual spending habits and the specific cards used – but the trend is clear: leveraging category-specific credit card rewards significantly increases the net value returned to consumers. By maximizing cash back and points on everyday purchases, families can offset a noticeable portion of their expenses – effectively "saving" money each year – simply by using smarter payment tools for the same spending they already do.

Overall, the data show that rewards optimization is well worth it. With the right guidance (for example, a service analyzing your budget and recommending "the best card for groceries, the best for gas," etc.), households can capture hundreds of dollars in otherwise forgone rewards. In practical terms, that could mean free grocery trips, subsidized vacations, or extra cash in the bank annually. The average family may earn only hundreds in rewards now, but with optimized credit card use, they could be earning thousands over the years to come – a smart financial boost for simply paying in a more savvy way.

Check Your Optimized Setup Today →

Sources:

- U.S. Bureau of Labor Statistics – Consumer Expenditures Survey, 2023.

- LendingTree analysis of rewards card usage.

- Bankrate personal finance case studies.

- Brandon Chhan, “How Much Can the Average American Earn with Credit Card Rewards?”

- Investopedia, “How To Get the Most Cash Back.”

Related on Learn

Hand-picked based on topic and reader interest

The 80/20 of Credit Card Rewards: The 5 Categories That Matter Most

Optimize these five categories and you will capture the majority of the upside without turning your life into a spreadsheet.

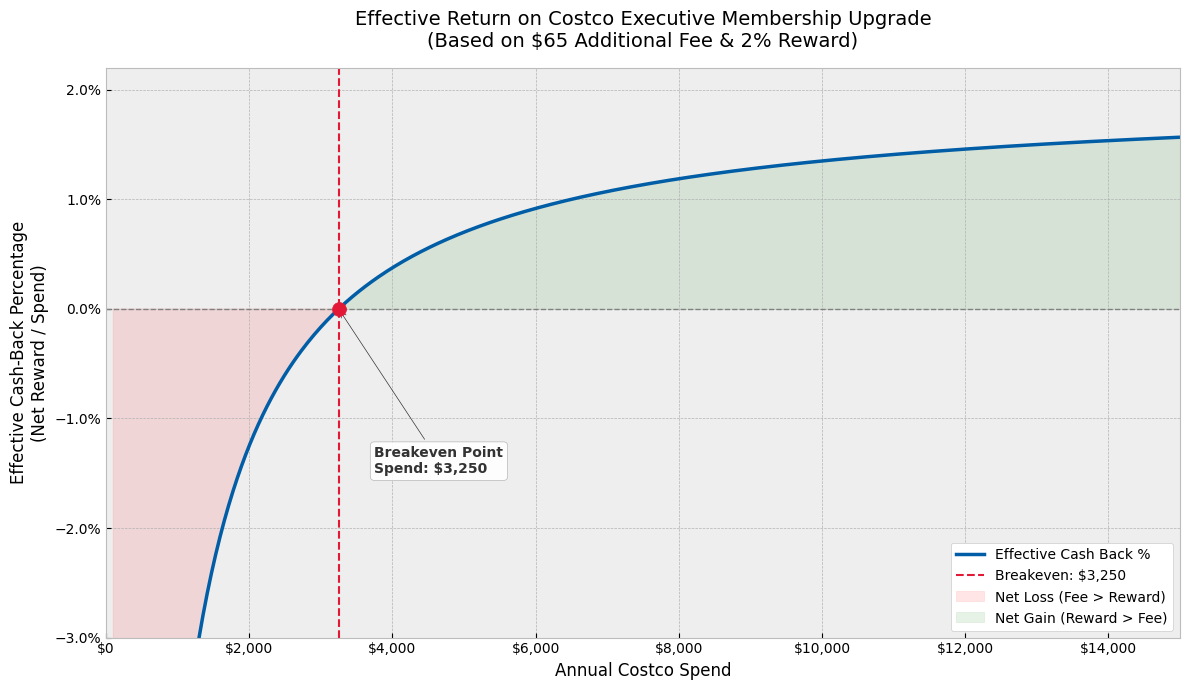

Are You *Really* Getting 2% Cash Back with Costco Executive? (The Math Says No)

The Costco Executive membership promises a 2% reward, but the $65 upgrade fee eats into your returns. We did the math to find your *true* effective cash-back rate.

Venture X vs. Sapphire Reserve: The 2026 Showdown

A clear, 2026-updated showdown between the simple Capital One Venture X and the perk-heavy Chase Sapphire Reserve.

The Battle of the $95 Annual Fee Cards (2026)

Math-first comparison of 15+ cards in the $95 tier. Net fee analysis, earning power, and the decision tree for flexible points, hotel keepers, and airline cards.

Get smarter with your cards

Weekly credit card strategy tips backed by math. No spam. Unsubscribe anytime.

Join 150+ readers. We respect your inbox.

Ready to optimize your wallet?

Get personalized card recommendations and spending strategies in under 2 minutes.

Free to use. No signup required.

Get My Strategy →