CSR vs. Prime Visa in 2026: The Quantitative Break-Even

Focus: Chase Travel Portal Bookings (Flights + Hotels)

If you book flights and hotels through the Chase Travel portal, the comparison between the Chase Sapphire Reserve (CSR) and the Chase Amazon Prime Visa in 2026 comes down to a single question:

How much extra value does the CSR’s higher earn rate generate, and is it enough to overcome the card's net annual cost?

Below is the clean, math-first break-even analysis for the new 2026 fee structure.

The Assumptions (Intentionally Narrow)

To isolate the variable that matters, we are only comparing:

- Portal bookings (Chase Travel flights + hotels).

- Rewards earned minus CSR annual fee plus CSR travel credit.

- Baseline redemption value (1.0¢ per point, ignoring "Points Boost" variance for the baseline).

Key Terms (2026 Data):

- CSR Annual Fee: $795

- CSR Annual Travel Credit: $300

- CSR Earn Rate (Chase Travel): 8x points

- Prime Visa Earn Rate (Chase Travel): 5% cash back (requires eligible Prime membership)

Valuation Baseline:

- CSR Baseline: 1.0¢ per point (conservative floor).

- Points Boost: Treated as upside rather than a guaranteed baseline, as availability varies dynamically.

Step 1: Convert to "Effective % Back"

First, normalize the rewards to a percentage return. If you redeem CSR points at a baseline of 1.0¢ per point:

- CSR (via Chase Travel): 8.0%

- Prime Visa (via Chase Travel): 5.0%

The Incremental Edge: The CSR generates an extra 3% return on portal spend compared to the Prime Visa.

Step 2: Determine CSR’s Net Annual Cost

We treat the travel credit as cash-equivalent (assuming you naturally spend >$300 on travel).

The CSR must generate $495 more in rewards than the Prime Visa annually to justify its slot in your wallet on a pure dollars basis.

Step 3: The Break-Even Calculation

Let be your annual spend on flights and hotels via the Chase Travel portal. The CSR wins when:

Solving for :

✅ The Baseline Break-Even: $16,500 If you redeem points at 1.0¢ each, you need to spend $16,500 per year in the Chase Travel portal for the CSR to mathematically outperform the Prime Visa.

A Reusable Formula (Plug in Your Valuation)

Since your personal valuation of Ultimate Rewards points () drives the math, here is the general formula to find your specific break-even spend ():

- = your value per point in dollars (e.g., 0.015 for 1.5¢).

- $495 = Net effective fee.

- and = The respective earn multipliers.

Sensitivity Analysis: The Impact of Valuation

Chase’s "Points Boost" can theoretically raise redemption values up to 2.0¢, though this is dynamic. Here is how higher valuations drastically lower the break-even bar:

| Effective Value per Point | CSR Effective Return (8x) | Incremental Edge vs. 5% | Break-Even Spend |

|---|---|---|---|

| 1.0¢ (Baseline) | 8.0% | 3.0% | $16,500 |

| 1.5¢ | 12.0% | 7.0% | ~$7,071 |

| 1.75¢ | 14.0% | 9.0% | $5,500 |

| 2.0¢ (Max Boost) | 16.0% | 11.0% | ~$4,500 |

The Punchline: If you reliably realize 1.75¢–2.0¢ per point via Points Boost or transfer partners, the break-even drops to a very accessible $4,500–$5,500. If you redeem at 1.0¢, the bar remains aggressively high.

Three Critical Caveats

- Prime Membership is Required: The Prime Visa's 5% earn rate is explicitly tied to an eligible Prime membership. Without it, the earn rate drops (typically to 3%), changing the math in CSR's favor.

- Portal Trade-offs: Booking via a portal often means sacrificing hotel elite benefits and points earning from the hotel chain itself. This "opportunity cost" is not captured here but is real for loyalists.

- Ancillary Benefits Ignored: This model ignores lounge access, DashPass, Lyft Pink, and insurance protections. If you value those perks at >$495, the break-even spend on travel is effectively $0.

The Card Savvy Takeaway

If you are optimizing strictly for "rewards earned vs. fees paid" on portal bookings:

- At 1.0¢ valuation: Stick with the Prime Visa unless you spend over $16,500 annually in the portal.

- At >1.5¢ valuation: The CSR becomes mathematically superior at just ~$7,000 of annual portal spend.

Related on Learn

Hand-picked based on topic and reader interest

Venture X vs. Sapphire Reserve: The 2026 Showdown

A clear, 2026-updated showdown between the simple Capital One Venture X and the perk-heavy Chase Sapphire Reserve.

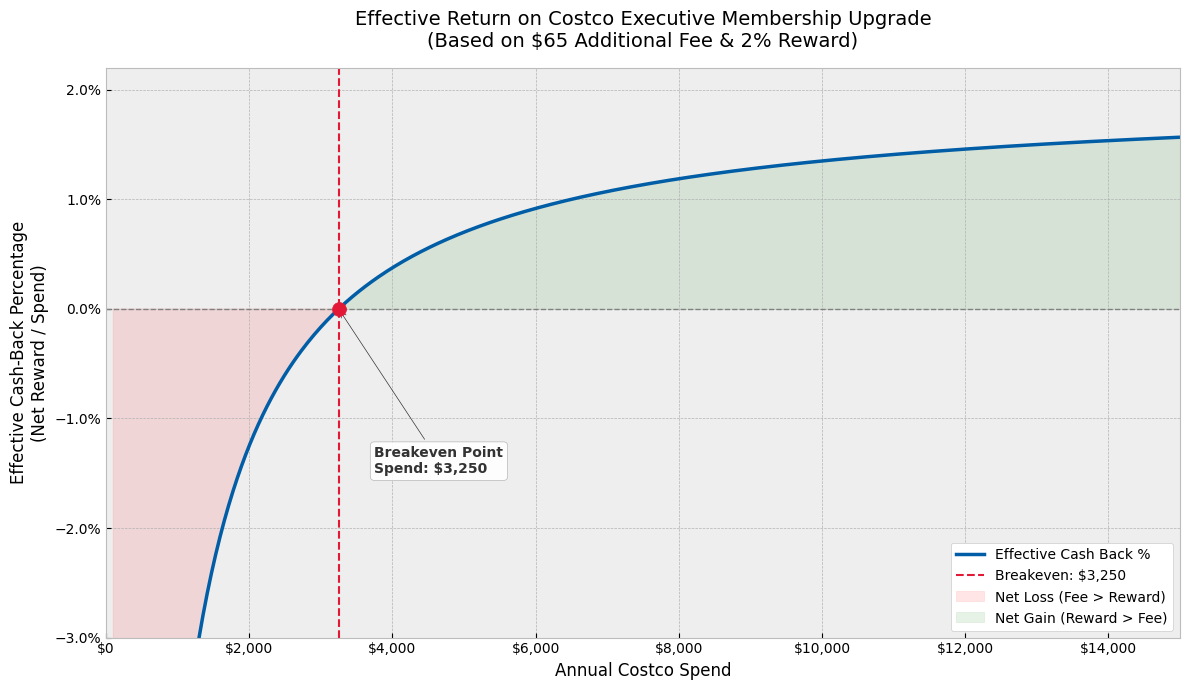

Are You *Really* Getting 2% Cash Back with Costco Executive? (The Math Says No)

The Costco Executive membership promises a 2% reward, but the $65 upgrade fee eats into your returns. We did the math to find your *true* effective cash-back rate.

Are Premium Card Credits Real Value or Forced Spending? A “Coupon-Book” Scorecard (2026)

We score the biggest premium cards of 2026—Amex Platinum, CSR, Venture X, and Gold—using a strict "Real Value" rubric to see if they are worth the fee.

The Battle of the $95 Annual Fee Cards (2026)

Math-first comparison of 15+ cards in the $95 tier. Net fee analysis, earning power, and the decision tree for flexible points, hotel keepers, and airline cards.

Get smarter with your cards

Weekly credit card strategy tips backed by math. No spam. Unsubscribe anytime.

Join 150+ readers. We respect your inbox.

Ready to optimize your wallet?

Get personalized card recommendations and spending strategies in under 2 minutes.

Free to use. No signup required.

Get My Strategy →