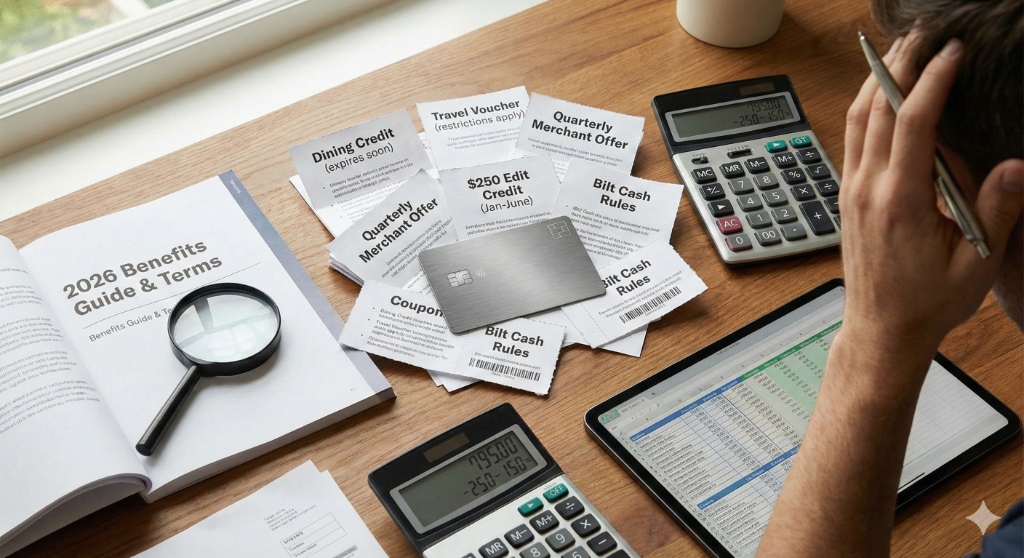

2026: The Year the 'Coupon Book' Credit Card Finally Jumped the Shark

There was a time when "optimizing credit cards" meant something pretty sane: pick one good travel card, maybe add a no-fee 2% card, and call it a day.

That era is over.

In 2026, premium travel cards have mutated into a full-on subscription bundle economy. We are seeing rising annual fees, exploding lists of merchant-specific credits, quarterly breakpoints, portal restrictions, and "value" that evaporates the moment your life doesn't match the issuer's preferred lifestyle.

And now we have a new mascot for this trend: Bilt Card 2.0.

When Bilt launched its new lineup, a Reddit commenter summed up the vibe perfectly: "I need an MIT professor to explain how this works."

Same.

Here is why 2026 is the year credit card complexity hit a breaking point, and how to navigate the mess without turning your wallet into a second job.

The Premium-Card Arms Race: Higher Fees, More Homework

The premium-card market has quietly moved into a new tax bracket. If you haven't checked the terms lately, the sticker shock is real:

- Chase Sapphire Reserve now carries a $795 annual fee (following its refreshed benefit stack).

- Amex Platinum has climbed to $895, justifying the hike with "$3,500+" of perks—many of which require active management to capture.

The pitch is always the same: "It pays for itself." But that logic only holds if you treat your credit card like a recurring project manager role.

As we discuss in our 2026 guide to Premium Card Credits, this is "Coupon-Book Economics." A massive annual fee is "offset" by a stack of narrow, fragmented credits that are increasingly easy to forget.

Why Issuers Love "Coupon Books"

Banks aren't stupid. They know a meaningful percentage of cardholders will:

- Forget to enroll.

- Miss a monthly deadline.

- Fail a portal requirement.

- Simply never use the credit at all.

In industry terms, that unused value is called breakage. In 2026, breakage isn't a bug in the system; it's the business model.

Chase Sapphire Reserve: The "Un-bundling" of Value

For nearly a decade, the Chase Sapphire Reserve was the anti-coupon card: Pay $550, get a $300 travel credit that worked on anything, and redeem points at 1.5 cents. Simple.

In 2026, that simplicity is officially dead.

With the fee jumping to $795, Chase has introduced a "value stack" that looks suspiciously like a homework assignment. The new math relies on credits that are fragmented by time and merchant:

- The Edit Credit ($500): Sounds great, until you realize it's split into two $250 biannual credits (Jan–June, July–Dec) that require a 2-night minimum stay.

- Exclusive Dining ($300): Also split biannually ($150 per half-year), and restricted to the "Sapphire Reserve Exclusive Tables" network on OpenTable.

- StubHub/Viagogo ($300): You guessed it—split biannually.

The Catch: If you book a hotel in June ($250 credit used) and don't travel again until December, you've unlocked the first half of your value but are scrambling to use the second half.

Furthermore, the legendary 1.5x Pay Yourself Back mechanic is being sunset in favor of "Points Boost"—a dynamic pricing model where points are worth "up to 2x" on select Chase Travel bookings, but significantly less on others.

It is no longer a "pay and forget" card; it is a "pay and manage" card.

Bilt 2.0: The Poster Child for Complexity

If Amex started the coupon book trend, Bilt 2.0 took it into the multiverse.

Bilt didn't just add credits; they introduced a new rewards currency and a set of rules that make valuation non-obvious. As detailed in our Bilt Card 2.0 Review, the new system effectively forces you to juggle two currencies:

- Bilt Points: The transferable points people actually want.

- Bilt Cash: A currency marketed like "4% back," but with major constraints.

Here is the part that makes eyes glaze over: Bilt Cash is not redeemable as statement cash. It is locked inside the Bilt ecosystem, expires at year-end, and is used as the mechanism to "unlock" housing points.

We have reached a point where earning rewards on rent requires a math exercise involving a second currency, expiration timing, and an implicit points "purchase price." If that sounds like a lot of cognitive load... that is exactly the point.

The Real Tax Isn't Money. It's "Cognitive Load."

When people argue about premium cards, they usually fight over points valuations and lounge access. But for most households, the bigger problem is simpler: The system is getting too complex to compare honestly.

It's not that consumers aren't smart enough. It's that product design is pushing everyone toward dozens of "micro-perks," multiple rulesets, and redemption paths that vary wildly by person.

This is why Ramit Sethi's credit card philosophy resonates so strongly right now. His argument that "your wallet shouldn't be a second job" is more relevant than ever. However, we still argue that most households leave meaningful value on the table by oversimplifying.

Both things can be true:

- Obsessing over points is a waste of life.

- The gap between "one-card simplicity" and "reasonable optimization" is now hundreds of dollars per year.

A Practical Framework: Stop Counting Face-Value Credits

How do you fix this without building your own spreadsheet? You have to stop looking at marketing math and start looking at effective math.

Here is the rule that fixes 80% of bad premium-card decisions: If a credit changes your behavior, it's not "value." It's a nudge.

When comparing cards like the Amex Gold vs. Platinum, apply a "Real Value" haircut:

- 100% Value: If you would buy it anyway.

- 50% Value: If you might use it.

- $0 Value: If you wouldn't buy it otherwise.

The Equation

This instantly clarifies why the Venture X remains popular (simple travel credits) while the Amex Platinum has become a polarizing "expensive hobby" for those who don't fit the specific lifestyle box.

Why 2026 Makes Tools Like CardSavvy Essential

When rewards systems were simpler, you could "just pick a good card."

In 2026, that advice breaks down. The "best" card is now entirely conditional on your real category spend, your tolerance for portals, and your willingness to deal with hassle.

This is exactly why we built the CardSavvy Optimizer.

We designed the tool to convert this mess into math. Instead of guessing if you will actually use a semi-annual dining credit or if Bilt Cash is worth the headache, the Optimizer runs your actual spending habits against these complex rulesets.

It allows you to choose a wallet strategy that fits your life, rather than trying to fit your life into a bank's marketing deck.

If 2026 is the year "coupon-book rewards" reached the next level, then it should also be the year you stop guessing. Because you shouldn't need an MIT professor to pick a credit card—you just need the right calculator.

Next Steps

- Analyze your wallet: Try the CardSavvy Optimizer to see which "coupon book" is actually worth your time.

- Deep Dive: Read our full Bilt Card 2.0 Review to understand the new currency math.

- Compare: Check out our Amex Gold vs Platinum breakdown.

Cards Mentioned in This Article

Related on Learn

Hand-picked based on topic and reader interest

The 2026 Guide to Airport Lounge Access: Best Cards & New Rules

Airport lounge access has changed in 2026 with new visit caps and guest fees. We breakdown the best cards for lounge access from Chase, Capital One, and Amex.

The Seattle Flyer's Guide: Best Travel Credit Cards for SEA (2026 Edition)

SEA isn't like other airports. This guide covers the best credit cards for Seattle frequent flyers in 2026, including lounge access strategies, Alaska Airlines perks, and winning card combos.

Best Alaska Airlines Credit Card 2026: Atmos Rewards vs Premium Cards

What's the best credit card for Alaska Airlines miles in 2026? We compare Atmos Rewards Ascent & Summit vs Chase Sapphire Reserve, Amex Platinum, and Bilt.

Bilt 2.0 Explained: Option 1 vs Option 2 (Which Wins?)

Confused by Bilt 2.0's new reward tiers? We break down Option 1 (automatic points) vs Option 2 (Bilt Cash unlock) with a free calculator to find your best pick.

Get smarter with your cards

Weekly credit card strategy tips backed by math. No spam. Unsubscribe anytime.

Join 150+ readers. We respect your inbox.

Ready to optimize your wallet?

Get personalized card recommendations and spending strategies in under 2 minutes.

Free to use. No signup required.

Get My Strategy →